On this page

- Non-ongoing employment agreement form

- Information regarding limitations to non-ongoing employment in accordance with the Fair Work Act 2009

- Exceptions to the non-ongoing limitations

- Onboarding a non-ongoing employee and additional forms

- Further support

- FAQs

Employment form

Non-ongoing employment agreement

When to use this form

This document should be used when engaging, or renewing, a non-ongoing employee under the Members of Parliament (Staff) Act 1984 (MOP(S) Act). Each agreement may cover a maximum period of 12 months. Upon expiry of the agreement, or promotion to a higher classification, a new agreement must be completed.

What is non-ongoing employment?

A non-ongoing employee is employed for a specified period, and may be employed on a full-time or part-time basis. Non-ongoing employees are entitled to paid leave in accordance with the Commonwealth Members of Parliament Staff Enterprise Agreement 2024-27 (MOPS EA).

A non-ongoing employee may be engaged against an established position, or the Electorate Support Budget (ESB), or a combination of both.

Each period of engagement (the employment agreement) must not be for a period of:

(a) more than 12 months against an established position, or

(b) extend beyond the relevant financial year if employed against the Electorate Support Budget.

Limitations on non-ongoing employment under the Fair Work Act 2009

Changes to the Fair Work Act 2009 (FW Act) restrict the use of non-ongoing contracts beyond certain limits, and therefore all parliamentarians (and authorised officers) must be conscious of their use.

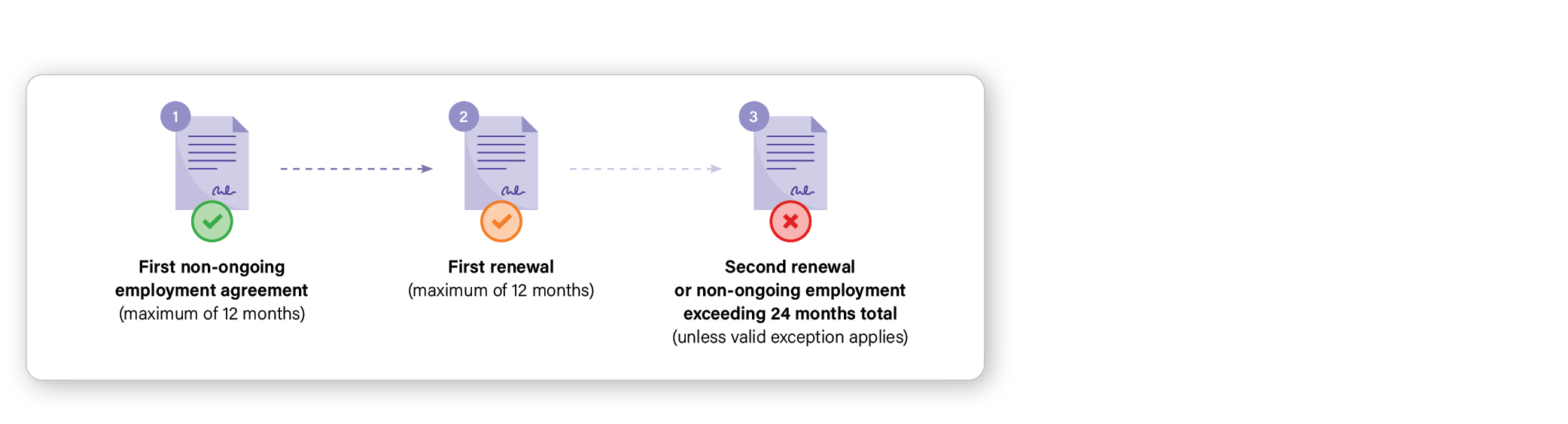

Specifically, changes to Section 333E of the FW Act state that non-ongoing contracts cannot be renewed:

- beyond a maximum contracted period of 2 years; or

- more than once (even if the total contracted period is less than 2 years).

Contract renewals must not be entered into with non-ongoing employees where they contravene these new provisions of the FW Act.

Exceptions to the FW Act limitations

There are some exceptions that apply which include:

- If the engagement is to undertake work during a temporary absence of another employee. For example, a non-ongoing employee who is engaged to backfill a period of parental leave or long service leave; or

- If the employee’s guaranteed earnings are over the high-income threshold in the year the contract is entered into.

If you think an exception applies, you are required to provide details in writing to the Parliamentary Workplace Support Service (PWSS) via HR@pwss.gov.au before an offer or renewal is made.

Onboarding a Non-Ongoing Employee – Additional Forms

The New Employees Tool can be used to determine which employment forms may be required, depending on the employee’s circumstances. Non-ongoing employees may be required to complete additional forms if:

- this is their first employment agreement under the MOP(S) Act

- it has been more than 12 months since they were last employed under the MOP(S) Act

- any personal details have changed since the last period of employment (such as personal particulars, taxation or superannuation)

- this period of MOP(S) Act employment is with a different parliamentarian from their last employment.

These additional forms must be completed by the employee and emailed separately to MOPSPayConditions@finance.gov.au.

Payroll Cut-Offs

Please submit all documents prior to the payroll cut-off to avoid any delays to payment or access to PEMS.

Late submission of any additional forms required can delay the processing of pay.

Further Assistance

FAQs clarifying the FW Act limitations are provided below.

If you have further questions after reviewing the FAQs, or would like assistance in determining how to implement the changes in your office, you can contact the Parliamentary Workplace Support Service (PWSS) HR Advice team on 1800 747 977 (option 2), or hr@pwss.gov.au.

FAQs regarding the FW Act limitations

When did the changes come into effect?

The FW Act amendment that limits the use of fixed term contracts came into effect on 6 December 2023 and applies to both personal and electorate non-ongoing employees employed under the MOP(S) Act.

Can I still renew a non-ongoing employee once?

Yes. A non-ongoing employee can be renewed once, before they reach the FW Act threshold.

Project scenario: Amy is employed as a non-ongoing staff member in an electorate office (EOB). Her non-ongoing contract is for 9 months to undertake a project. The project will take longer than expected due to the uncertainty of the timing of the election and the Parliamentarian wishes to renew Amy’s employment. Amy’s non-ongoing contract can be renewed once, but cannot exceed 2 years total non-ongoing employment. Amy receives a contract renewal for a further 6 months.

Can I still employ non-ongoing employees including against my Electorate Support Budget?

Yes, as long as the thresholds of the fixed-term provisions have not been reached, you can continue to employ non-ongoing employees either fully or partially against your ESB. Generally, you will be able to employ a non-ongoing employee for up to two years and renew their employment once.

What if my employee and I agree to end employment at the end of our existing agreement?

As long as the thresholds of the fixed-term provisions have not been met, the non-ongoing agreement can cease as usual.

Will my non-ongoing employees be eligible for severance at the election?

No. Non-ongoing employees are not eligible for severance. Per clause 73.1 of the MOP(S) Enterprise Agreement 2024-2027, only ongoing employees are eligible to receive severance in certain circumstances.

Does previous non-ongoing employment count towards the limitations?

Yes, previous non-ongoing employment (even with another parliamentarian) may be included when considering if the thresholds for fixed-term provisions have been met. The PWSS can assist with determining if previous non-ongoing employment will count toward the FW Act limitations.

What if there was a break in service between employment agreements?

Previous non-ongoing employment (even if there is a break in service) may be considered when determining if the thresholds for the fixed-term provisions have been met. The PWSS can assist with determining if it is considered a genuine break in service noting that section 333H of the FW Act prohibits certain actions being taken by an employer in order to avoid the application of the fixed-term provisions.

Can I prevent my employees from reaching the fixed term limits?

Section 333H of the FW Act outlines anti-avoidance provisions which prohibit employers from making changes to employment relationships in order to avoid the application of the provisions. For MOP(S) Act employees these include:

- Terminating an employee’s employment for a period (i.e. forcing a break in service)

- Delaying re-engaging the employee for a period

- Not re-engaging an employee and instead engaging another person to perform the same or substantially similar work

- Changing the nature of the work or tasks the employee is required to perform.

Civil penalties could apply if an employer is determined to have breached the anti-avoidance provisions.

Are there any exceptions to the limitations that apply?

There are some exceptions that apply under the FW Act which include:

- If the engagement is to undertake work during the temporary absence of another employee. For example, a non-ongoing employee who is engaged to backfill a period of;

- parental leave, or graduated return to work following parental leave

- long service leave

- extended personal leave

- If the guaranteed earnings are over the high-income threshold in the year the contract is entered into.

If you think an exception applies, contact the PWSS. You are required to advise the PWSS in writing of any exception when you submit the non-ongoing agreement.

What do I need to do if I regularly employ non-ongoing employees and believe I have staff that are impacted by these changes?

The PWSS will proactively be contacting offices to ensure appropriate arrangements are in place for those staff members impacted.

What do I need to do if I have a non-ongoing employee whose agreement is due to end shortly?

If it is your intention to renew the employee, the fixed-term provisions apply and may limit employment arrangements. This means you may not be able to employ the person as a non-ongoing employee. The PWSS can provide advice on employment options including the most appropriate type of employment for roles within your office.

What do I need to do if I have an employee who has been non-ongoing for more than two years?

You may not be able to employ the person as a non-ongoing employee. The PWSS can provide advice on employment options including the most appropriate type of employment for roles within your office.

What do I need to do if I have an employee who has had their non-ongoing agreement extended more than once?

You may not be able to employ the person as a non-ongoing employee. The PWSS can provide advice on employment options including the most appropriate type of employment for roles within your office.

What do I need to do if I need to make my employee ongoing, to comply with the FW Act changes, but don’t have a vacant position?

Contact the PWSS before you consider engaging or renewing a non-ongoing employee to ensure appropriate arrangements are in place for those staff members impacted.

What if my non-ongoing employee does not want to become ongoing?

If your employee does not wish to take up ongoing employment and they have already met the threshold of the fixed-term provisions, then the arrangement can be ceased at the employee’s request in writing. Any decision to alter an employment relationship in these circumstances should be well documented.

What do I do if my non-ongoing employee is not meeting my expectations and I had planned not to rehire them when their non-ongoing agreement ceased?

The PWSS can assist you with managing employment performance matters within your office.